941 Instructions 2025

941 Instructions 2025. It’s due on a quarterly basis and is part of your responsibility to withhold payroll taxes. The draft form 941 ,.

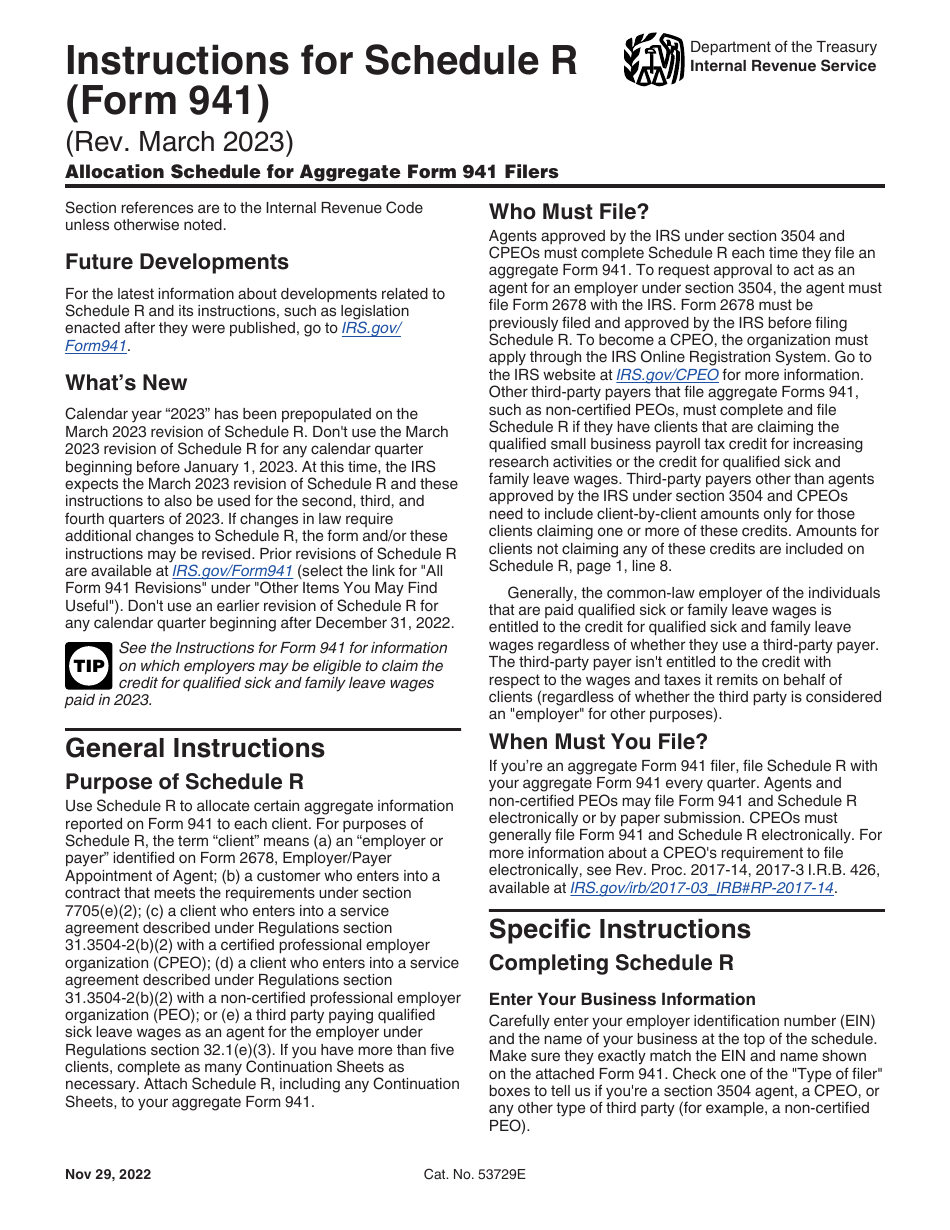

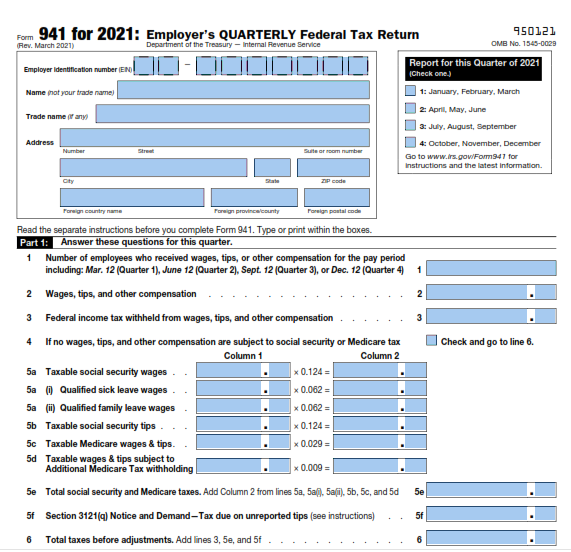

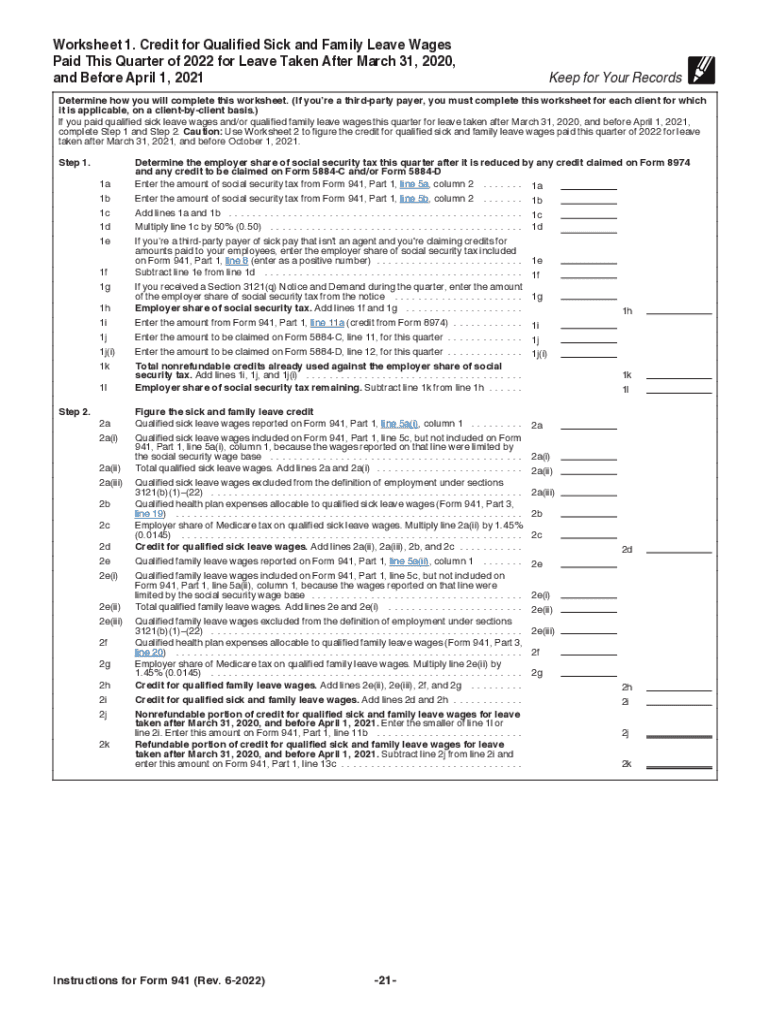

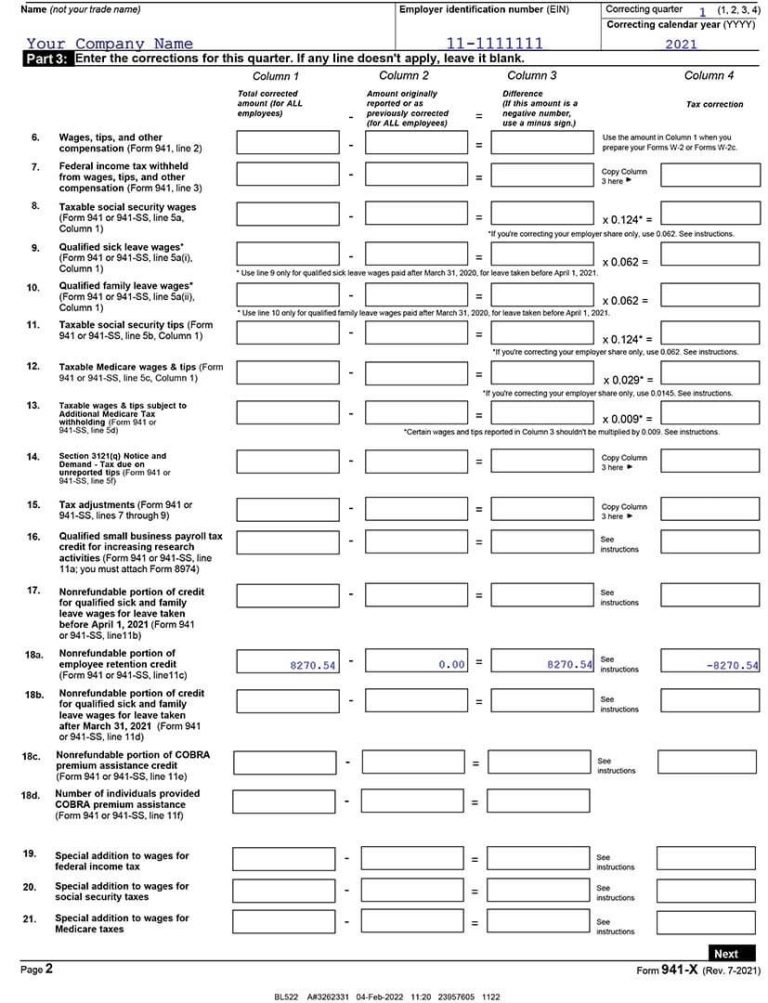

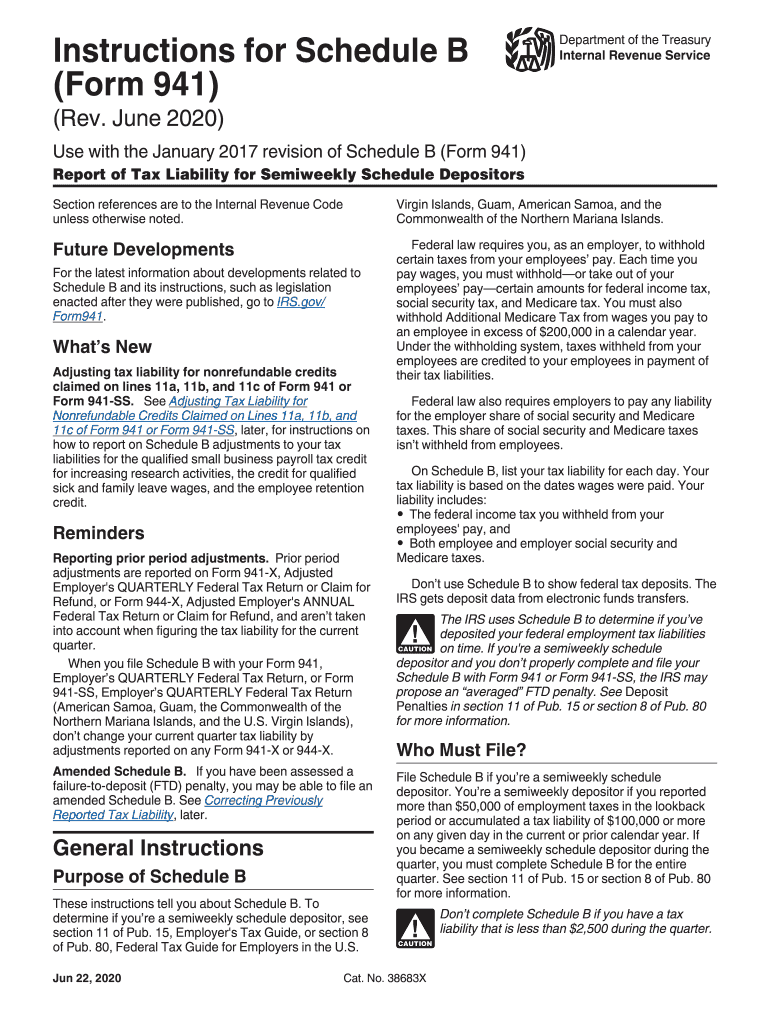

This webinar covers the irs form 941 and its accompanying form schedule b for 2024 and 2025. Irs form 941, employer’s quarterly federal tax return, is filed by employers to report employment taxes withheld from their employees’ paychecks and the employer’s share of.

941 Instructions 2025 Images References :

Source: nataliestarr.pages.dev

Source: nataliestarr.pages.dev

941 Form 2025 Schedule B Natalie Starr, Review of schedule b and the importance of completing correctly review of who should.

Source: isaacbutler.pages.dev

Source: isaacbutler.pages.dev

941 Quarterly 2025 Form Instructions Isaac Butler, In this article, we’ll give you the instructions to file 941 form 2024 and explain the content of the form while answering commonly asked questions.

Source: honorqleisha.pages.dev

Source: honorqleisha.pages.dev

2025 Form 941 Instructions Becca Carmine, Form 941 businesses must file form 941 quarterly to report employee wages and payroll taxes.

Source: elorabsidonia.pages.dev

Source: elorabsidonia.pages.dev

Form 941 Schedule B 2025 Marie Rosaline, It discusses what is new for this version as well as the requirements for completing each.

Source: jancampbell.pages.dev

Source: jancampbell.pages.dev

Where To Send 941 Quarterly Report 2025 Jan Campbell, To complete your form 941, you can find the instructions included with your form.

Source: audreymcdonald.pages.dev

Source: audreymcdonald.pages.dev

941 Form For 2025 Audrey Mcdonald, Businesses with employees must file the 941 form 2024.

Source: sallystewart.pages.dev

Source: sallystewart.pages.dev

941 Form 2025 Schedule B Fillable Joice Margarita, Washington — as the nation's tax season approaches, the internal revenue service is reminding people of simple steps they can take now to prepare to.

Source: franniykonstance.pages.dev

Source: franniykonstance.pages.dev

Form 941 2025 Schedule B Briana Tiffani, Washington — as the nation's tax season approaches, the internal revenue service is reminding people of simple steps they can take now to prepare to.

Source: elorabsidonia.pages.dev

Source: elorabsidonia.pages.dev

Form 941 Schedule B 2025 Marie Rosaline, You can file for free through the mail, online for a fee through an irs.

Source: brinablaurette.pages.dev

Source: brinablaurette.pages.dev

2025 Form 941 Schedule B Aurea Suellen, Each quarterly tax return is due by the last day of.

Posted in 2025